Poland Unpacked week 1 (29 December-4 January 2026)

Welcome to this week’s edition of our Poland Unpacked, where we deliver key insights and trends shaping the economic, corporate and political landscape. Catch the most important insights from Poland in this week’s briefing.

This article is a part of Poland Unpacked. Weekly intelligence for decision-makers

Companies planning to invest in Poland can count on tax reliefs and grants - especially if they locate operations in one of the country’s 14 Special Economic Zones. We take stock of what happened there over the past year. While the aggregate value of supported investment projects is not dazzling, many of the 14 zone operators posted record results. Here is what they expect in the year ahead.

Beyond industrial projects, Poland has for years been growing on the back of foreign investment in services. Modern business services centers have become a sturdy pillar of the economy, driving positive labor-market trends for a long time. Now, however, they face a major shift linked to artificial intelligence. In 2026, some service centers will shut down or reduce headcount, while new ones will emerge - smaller, typically European, and more specialized. Here are five trends shaping the business-services sector.

Over the past three years, Polish banks have benefited from high interest rates and, more recently, from sharply lower provisions for Swiss-franc mortgages, alongside a growing volume of new home loans. The result: record profits. But tougher terrain lies ahead. Here are the sector’s biggest challenges and key trends - and why a repeat of those record results is off the table.

This year, Poland is set to turn into a vast construction site for megaprojects. Groundbreaking is planned for the Port Polska hub (formerly CPK), work is to begin on high-speed rail, and Warsaw’s Chopin Airport is slated for modernization. These are projects of immense strategic importance. The question is whether plans years in the making can be delivered amid rapidly shifting political conditions.

One landmark investment in Poland will be completed this year: the launch of the first offshore wind farm in the Polish section of the Baltic Sea. The year will also bring progress on the nuclear power plant contract—and a revolution for electricity consumers. We highlight several key developments in the energy sector to watch this year.

Although more than three years have passed since the pandemic upended Poland’s restaurant scene, the hospitality industry is still struggling to regain its footing. While the number of venues has risen by a few percent this year, complaints and anxieties are growing louder across the sector. Several once-fashionable addresses have recently vanished from Warsaw’s streets. Here are the trends set to have the strongest impact on gastronomy in the year ahead.

The turn of the old year into the new has ushered in a fresh round of sharp confrontations at the apex of Polish politics. The president and the prime minister -representing rival political camps – delivered New Year addresses marked by pointed, and at times caustic, exchanges.

On New Year’s Eve, President Karol Nawrocki delivered his address. He argued that Poles, by electing him president last year, had shown that “the affairs of the state are not going in the right direction, that change is needed,” and that this is “the direction in which we should be heading” – a message clearly aimed at the government of Donald Tusk.

On New Year’s Day, Prime Minister Donald Tusk responded with his own address, directly taking aim at President Nawrocki. He warned that “rowdy obstructionism” amount to weakness and defeat. To date, President Nawrocki has vetoed 20 government bills in just five months – an unprecedented pace. The prime minister likened the president’s actions to the ignoble tradition of Poland’s 18th-century nobility, when the objection of a single deputy was enough to dissolve the Sejm (notorious liberum veto). The dueling addresses suggest that the final year before the parliamentary elections will be fraught with tension.

Just before the end of the year, a draft bill on the status of a “closest person” was submitted to parliament. Poland remains one of the last countries in Europe where same-sex couples cannot formalize their relationships. Yet even within the governing coalition there was no agreement on introducing registered partnerships. The proposed legislation instead provides for a “cohabitation agreement,” granting a range of rights related to taxation and social benefits. The bill could potentially cover up to 2.2 million people in heterosexual relationships and 162,000 people in same-sex relationships.

The proposal was introduced by ministers from the New Left. The party is competing for left-wing voters with Razem (Together), with which it twice ran jointly in parliamentary elections. Their cooperation ended several months ago, as Razem has refused to support Donald Tusk’s government.

Next week will see the first sitting of the Sejm this year. On January 10, the first round of internal elections will take place in Poland 2050, a centrist party that is part of the governing coalition. Szymon Hołownia – former Catholic journalist and television host – will step down as party leader. After losing the presidential election, he also failed in his bid for the post of United Nations High Commissioner for Refugees.

We also report on the situation surrounding Defense Minister Władysław Kosiniak-Kamysz (the Polish People’s Party-PSL), analyzing the most demanding challenges that await him in 2026.

Poland’s economy is expected to grow strongly in 2026. This conclusion emerges from an analysis of 20 forecasts by Polish and international institutions – including banks, think tanks, and public bodies. According to these projections, real GDP growth will range between 3.1% and 4.2% this year. The median forecast is 3.6%. We are even more optimistic, believing growth could reach 4%. If so, the economy would accelerate further following a strong 2025.

Consumption and investment are expected to be the main growth drivers. On the consumption side, a key factor will be robust growth in real wages, as well as pensions and social benefits. A decline in household savings rates could also contribute. Investment, meanwhile, will be fueled primarily by European Union funds – from the Recovery and Resilience Plan (which must be fully spent by the end of 2026) and the cohesion fund. Infrastructure projects, such as Port Polska (formerly the Central Communication Port), will further support investment.

Inflation forecasts are equally encouraging, with all projections indicating that it will remain within the central bank’s target. For reference, the National Bank of Poland (NBP) defines this target at 2.5%, with a tolerance band of ±1 percentage point – effectively a range of 1.5–3.5%. The median forecast for inflation is 2.6%, with projections ranging from 2.2% to 3%. We expect inflation to settle at around 2.5%. This could pave the way for modest interest rate cuts by the NBP, potentially lowering rates from the current 4% by 0.5–0.75 percentage points.

The main risks to inflation are external: rising energy and food prices, or structural shifts in China, which is currently “exporting” deflation. However, we assess the likelihood of these risks materializing as low.

At the start of the year, attention will turn to the development of the Innovate Poland program. On January 8, BGK (state development bank) will hold a press conference to present progress on its implementation. In the coming weeks, the Ministry of Digital Affairs will make a decision on the future of building an AI gigafactory in Poland. The plans are ambitious, but by the turn of 2025–2026, the project had encountered unexpected hurdles. According to a new concept from the European Commission, participation in the projects could include, for instance, American corporations. This sparked strong controversy, prompting some countries to withdraw from the construction of the factories.

Early in the year, the framework for a digital tax will also be unveiled.

What else is on the horizon?

In December 2025, the Polish Development Fund (PFR) announced a new strategy. In the coming years, PFR will focus on directing capital where it is most scarce and where it can deliver the greatest benefit to the Polish economy: towards Polish technology companies with the potential for spectacular growth and innovation. This approach is embedded in PFR’s new strategy for 2026–2030, which draws inspiration from France, where the so-called Tibi plan was implemented in recent years.

The backbone of the strategy will indeed be the Innovate Poland program, but new initiatives are expected.

“We are expanding initiatives such as PFR DeepTech and Innovate Poland, investing in infrastructure, energy transition, international expansion of Polish companies, and dual-use technologies, creating a modern investment ecosystem,” said Mikołaj Raczyński, PFR Vice President for Investments, at the press conference presenting the strategy.

Existing programs will also undergo changes. For example, PFR Ventures, the startup arm of PFR, plans to revise the criteria for selecting funds under the CVC program (corporate venture capital) and encourage funds participating in the Starter program to provide greater support to Polish science.

A new sub-strategy, tentatively named Starter Science, aimed to close the gap in financing innovations from Polish universities by introducing strong financial incentives to motivate managers to engage in more challenging but strategically important scientific projects.

We can also expect an offensive from funds that have received capital from PFR Ventures. In the coming months, the next cohort of fund managers to receive state support will be announced.

Polish startups themselves are preparing their own offensive – not only raising additional financing rounds but also advancing new technologies. One particularly interesting case is Bielik, a Polish generative AI model. The company benefits from a powerful new private AI factory and technological support from InPost. A new version of the model is expected in the coming weeks. Another noteworthy project, PLLuM, is being developed under the aegis of the Ministry of Digital Affairs. Here too, developments are expected, particularly regarding support from public administration.

Christelle Oyiri multimedia installation Ghost Rider summons the spirits of working-class Black creators whose experiments laid the foundation for contemporary club culture. The exhibition features a film, bronze self-portrait sculptures from her 2025 Tate Modern show, and a new sculpture inspired by the DJ console created specifically for this space.

The installation breathes with its audience — sensors translate visitor movements into sound impulses that choreograph the lighting, making each body a transmitter of memory. As curator Michał Grzegorzek notes, the room becomes not just an exhibition space but a medium itself.

Where: Warsaw, Zachęta Art Gallery (https://zacheta.art.pl/)

When: until 1 February 2026

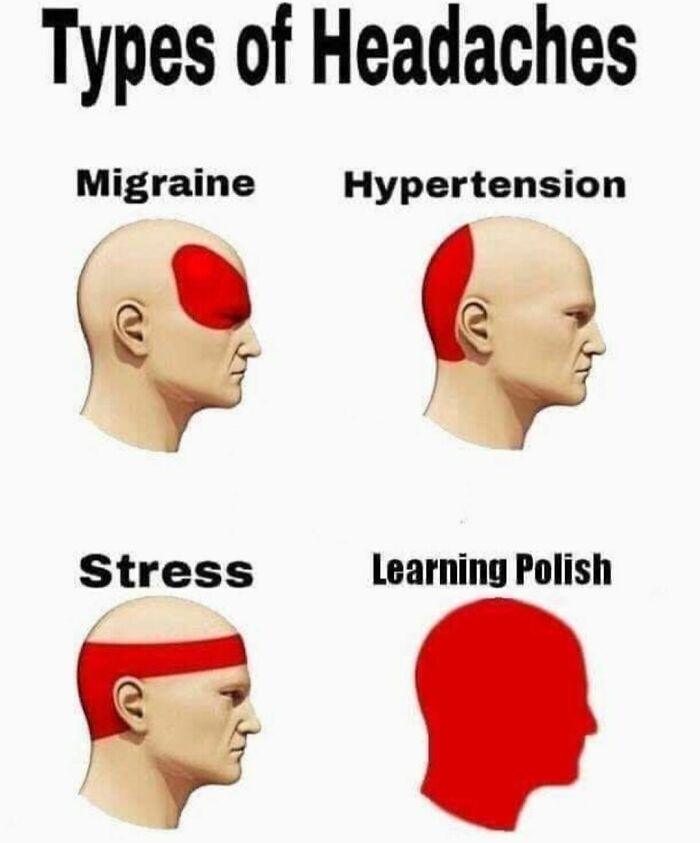

Yes, it's that time of the year. And no, we're not talking about going to the gym.

Learning Polish is what you've promised yourself. Excellent choice! Why? How about this: a group of researchers (The University of Maryland (UMD) and Microsoft ) studied which language is best understood by artificial intelligence. Polish is in the lead and English only ranking at sixth place.

And another good news. You need approximately 44 weeks to achieve professional working proficiency in Polish, at least according to U.S. Department of State. See? Less then a year, so start today.

Want to stay even closer to the stories behind Poland Unpacked? Join our LinkedIn community! This is where we share our stories during the week and a place to connect with other readers and exchange views.

Follow us on LinkedIn and be part of the conversation: https://www.linkedin.com/showcase/plunpacked/