Poland Unpacked week 3 (12-18 January 2026)

Welcome to this week’s edition of our Poland Unpacked, where we deliver key insights and trends shaping the economic, corporate and political landscape. Catch the most important insights from Poland in this week’s briefing.

This article is a part of Poland Unpacked. Weekly intelligence for decision-makers

The week’s standout story focused on a private ammunition manufacturer, the Niewiadów facilities. After several months of effort, Michał Lubiński, co-founder and now adviser to the company’s board – who typically avoids the media – granted the interview. The manager discussed large-scale contracts and investments, as well as the difficult relationships between private defense companies and the state and the state-owned enterprises in the sector. These unequal battles sometimes end up in court. Several years ago, Mr. Lubiński was detained, which he attributes to actions by competitors. He later won a case against the Polish state at the European Court of Human Rights in Strasbourg, receiving compensation.

The Niewiadów Group originated from a former state-owned enterprise with a history exceeding 100 years. It is currently expanding its artillery ammunition factory. The London-based Fidera fund has invested PLN 250 million in the project. The company is listed on NewConnect and is in the process of moving to the Warsaw Stock Exchange’s main market, with a current valuation of PLN 1.9 billion.

Carlsberg Poland has become an innovation hub within the group, thanks to popular brands such as Garage and Sommersby. Mieszko Musiał, the company’s CEO and head of the Polish Brewers Association, predicts a decline in alcoholic beer sales and consumption, alongside growth in the non-alcoholic segment. He does not rule out the development of so-called functional beer products.

Musiał also comments on market practices. In his view, promotions offering twelve beers for the price of six encourage far worse consumer habits than beer sales at petrol stations. He praises the introduction of nighttime alcohol bans in several Polish cities but criticizes the national deposit system, which fails to consider mechanisms developed by producers. Carlsberg has been allowed to maintain its own producer-managed deposit system, developed over the past 20 years, through which 90% of glass bottles are returned.

mBank is one of only two Polish banks – alongside the giant PKO BP, of which nearly 30% of shares are held by the state Treasury – with branches abroad. Eighteen years ago, mBank debuted in Czechia and Slovakia. Today, both markets are dominated by banks controlled by the likes of Austria’s Erste Group, Belgium’s KBC, and France’s Société Générale.

The bank currently holds 4–5% of assets in these markets, but in terms of customer numbers, it serves 1.2 million people – nearly 10% of adults. Robert Chrištof and Roman Fink, who head the Czech and Slovak operations, have announced plans to double the bank’s share of both the lending and deposit markets.

Family foundations – a mechanism enabling entrepreneurs to manage wealth with tax advantages – have been in operation in Poland for just under two years. The system has become congested. Entrepreneurs now wait up to 14 months for registration. Since May 2023, 3,140 family foundations have been registered, with 2,434 still awaiting entry. Documents are submitted in paper form, and the workload is handled by just four clerks.

This week, Poland 2050 was due to elect a chair. The centrist party is one of four that make up the governing coalition. In the second round of the party’s electronic vote, the contenders were Paulina Hennig-Kloska, the minister for climate, and Katarzyna Pełczyńska-Nałęcz, the minister for regional policy. The round was annulled after a system failure.

Szymon Hołownia – the party’s founder and current leader – began publicly to weigh a run. After losing the presidential election, he had wanted to step back from frontline politics and had previously ruled out standing. Time is now tight: the party has ever less room to maneuver, as the executive board’s term expires on Wednesday.

The political temperature also rose this week around Zbigniew Ziobro, a former justice minister and a divisive figure in Polish politics. Prosecutors want to bring 26 charges against him, including leading a criminal group and mismanaging public funds. On Monday, Mr. Ziobro said he had been granted political asylum in Hungary. Law and Justice (the opposition party that governed from 2015 to 2023, and of which Mr. Ziobro is a vice-president) maintains good relations with Prime Minister Viktor Orbán. Representatives of the Polish government insist, however, that asylum for Mr. Ziobro has not been confirmed through any international procedure. He has avoided returning to Poland for several months, since his parliamentary immunity was lifted.

Mr. Ziobro argues that he could not expect a fair trial in Poland, even though proceedings to place him in pre-trial detention were postponed for a second time on Thursday. Within Law and Justice (PiS), voices are increasingly heard that his conduct is damaging to the party.

President Karol Nawrocki met Prime Minister Keir Starmer in London. Their talks covered security, among other issues, and the G20 summit. The president also met the heads of the intelligence services and the ministers overseeing them. Earlier, he had blocked a round of officers’ promotions. The issue has now resurfaced.

We also examined the heads of state-owned companies. Contrary to earlier assurances, not all appointments are free of political ties – though there are fewer such links than under the previous government. In some firms the turnover has been heavy. One example is PZU, the insurance giant, which has already had five chief executives.

Who trended in December in the political mediasphere? The names that dominated were those of President Nawrocki and Prime Minister Donald Tusk. Also prominent was Sławomir Mentzen, a politician from the far-right Confederation party. Grzegorz Braun, a controversial MEP known for antisemitic and pro-Russian views, also gained in popularity.

The most important macroeconomic development in Poland last week was the decision to keep interest rates unchanged. The reference rate therefore remains at 4%. This marks a pause after a series of cuts that lowered rates by a cumulative 1.75 percentage points. Monetary policymakers argue that the pause is intended to assess the impact of those reductions on price dynamics and overall economic conditions.

Further rate cuts in the coming months remain highly likely, though on a smaller scale. Based on comments from the central bank governor, we expect reductions of 25 basis points in both the first and second quarters of this year. The key argument in favor of easing is the sustained decline in inflation. Statistics Poland (GUS) confirmed that in December 2025 inflation stood at 2.4% year on year – almost perfectly aligned with the inflation target.

We also received export data, which were slightly disappointing in November. Growth (measured in euro terms) slowed to 2.7% year on year, down from 6% in October. Looking at the broader picture over the past twelve months, export growth came in at 4.8% year on year – the highest reading since the first half of 2023. Over the same period, imports increased by 4.4% year on year.

Poland’s exports are expanding primarily to Western markets, while losing ground in the East. That is the main conclusion of our geographic breakdown of export performance. This is good news, as the West offers the largest markets for Polish goods. There is, however, one caveat. Among the product categories posting the strongest growth are clothing and accessories, as well as toys, games, and sporting goods – items that Poland produces in very limited quantities. It is therefore likely that part of the reported export growth actually reflects re-exports of goods from Asia, chiefly China.

We also sought answers to a broader question: what needs to be done to ensure that Poland’s golden age does not come to an end? The task will become increasingly difficult as the economy moves closer to the technological frontier. Valuable lessons can be drawn from the experiences of Japan and Italy.

Technologies developed in Poland are increasingly being noticed – and commissioned – by foreign clients. The Polish company Satim has become a partner of Germany’s Bundeswehr in a project to build a satellite constellation. This deeptech firm has developed a tool without which even an advanced constellation of satellites equipped with SAR radars would, in practice, be useless. Satim has created AI-based software capable of extracting detailed intelligence from radar images that are otherwise difficult to interpret.

The company’s international success could also have meaningful implications for Poland’s own security, as the country is developing its own SAR capabilities. Satim is already in talks with Poland’s Ministry of National Defense about deploying its tool within the domestic MikroSAR satellite system.

The regional Industrial Development Agency has presented a report on the condition of Poland’s space sector. While this remains a relatively young market in Poland, companies are steadily building capabilities and winning international contracts year after year. Estimates suggest the sector has reached a turning point: in 2025, the combined financial results of the 30 most important firms were positive.

Last year also saw a significant increase in the government’s contribution to the European Space Agency (ESA). A Polish astronaut flew on a mission to the International Space Station, and preliminary talks began on opening a local ESA center in Poland.

OpenAI recently announced the launch of ChatGPT Health. Technology initiatives of this kind have a direct impact on both users and businesses. Medtech and healthtech continue to attract strong interest from venture-capital investors. We spoke with Ligia Kornowska of the AI in Health Coalition, co-founder of Data Lake, about the impact of AI on the organization of healthcare – and on the operations of Polish startups.

Following the unblocking of EU funds and fresh inflows into public-private venture-capital vehicles, the market is seeing a new wave of startup investments. Among the beneficiaries is Ludus AI, which has raised capital to scale tools designed to accelerate the work of developers building games and audiovisual projects using Unreal Engine. Notably, these tools have begun to attract interest from other industries as well – from automotive to the defense sector.

This week Poland 2050 is expected to settle its leadership contest.

President Karol Nawrocki is due to decide on the state budget bill. He cannot veto this legislation. It is not out of the question, however, that he will refer it to the Constitutional Tribunal, where judges appointed by Law and Justice (PiS) hold sway.

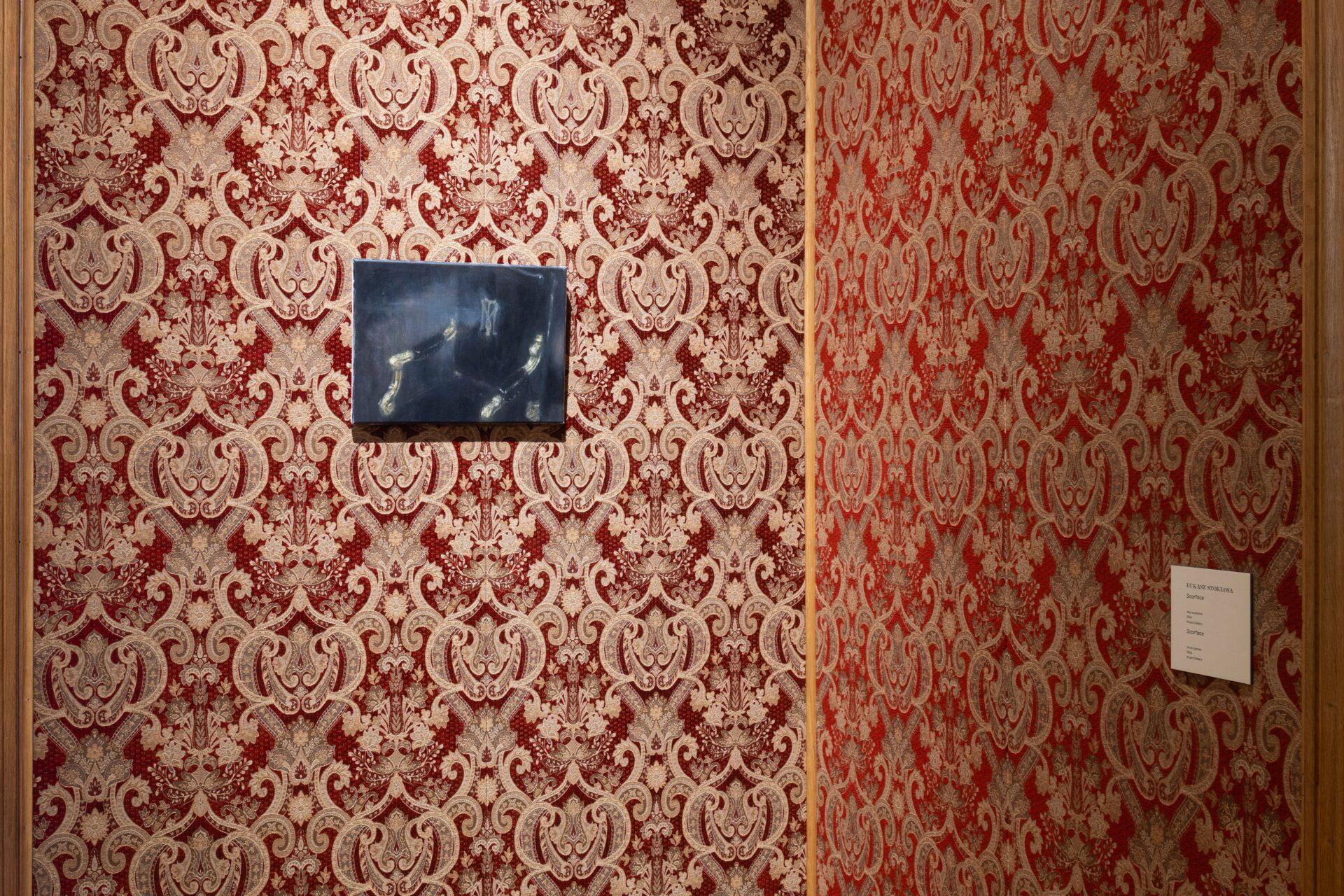

“Shining” (Lśnienie), the new Łukasz Stokłosa show at Warsaw’s Royal Castle, is basically a ghost story set inside Poland’s most official interiors. Moody, near-empty rooms and corridors from Stokłosa's works quietly hijack the usual script of heroic Jan Matejko canvases and state pomp.

What you get is the castle turned into something closer to a cinematic set rather than a history textbook. 29 paintings are scattered along the standard visitor route to be a slow-burning invitation to wander after hours - when the royals are gone, the crowds thin out and the building starts to feel like it’s remembering itself out loud.

When: until 27 September 2026

Where: Royal Castle in Warsaw (https://zamek-krolewski.pl/en/aktualnosc/2781-lukasz-stoklosa-shining)

24 January is International Day of Education, so just letting you know that Poland boasts one of Europe’s ancient academic gems. The Jagiellonian University in Kraków, founded in 1364 by King Casimir the Great, is the oldest in Poland and still kicking after 662 years. Jagiellonian’s royal charter boasts continuous operation through plagues, partitions, and WWII – talk about resilient scholarship. Today, it’s less “medieval scriptorium” and more labs and grants – proving Poland’s brain trust ages like fine wine.