Poland Unpacked week 6 (26 January - 1 February 2026)

Welcome to this week’s edition of our Poland Unpacked, where we deliver key insights and trends shaping the economic, corporate and political landscape. Catch the most important insights from Poland in this week’s briefing.

This article is a part of Poland Unpacked. Weekly intelligence for decision-makers

On February 1 Poland launched KSeF, the National e-Invoicing System (Krajowy System e-Faktur), marking a major step in the digitalization of document flows. Paper invoices are being replaced by structured invoices – XML files transmitted electronically. All taxpayers must now be able to receive e-invoices, though only the 4,200 largest companies, with 2024 revenues above PLN 200 million (EUR 47.5m), are currently required to issue them. Mandatory issuance for most firms begins on April 1.

One likely effect of KSeF is easier identification of individuals formally operating under B2B arrangements who, in practice, should be hired on standard employment contracts. While B2B models offer lighter taxation and lower social-security contributions, they also provide weaker labor protections. Poland’s National Labor Inspectorate has been targeting such cases, and KSeF will give authorities faster and more comprehensive access to data, experts believe. Still, access to data does not guarantee effective enforcement.

In 2025 a government unit operating under NASK, Poland’s cybersecurity research institute, sought to curb the use of celebrities’ images in online scams. It submitted more than 9,000 reports to Meta, owner of Facebook and Instagram. Meta rejected 4,725 of them (52%) and disputes claims that it routinely ignores reports from Polish public institutions.

Another uneven battle is playing out at Grupa Azoty, Poland’s largest fertilizer producer with state as one of the investors. In 2023, the group opened a polypropylene plant in Police that cost over PLN 7 billion (about EUR 1.6 billion). The facility remains idle due to serious technical defects. Azoty is locked in a legal dispute with the general contractor, South Korea’s Hyundai Engineering, while banks have demanded immediate loan repayment. Under mounting pressure, the group is negotiating a creditor agreement crucial to its survival and is also in talks to sell the plant to Orlen, the state-owned fuel group.

A contrasting picture emerges at PZU, Poland’s largest insurer, with state as one of the investors as well. PZU is preparing for further growth through a planned merger with Bank Pekao. Bogdan Benczak, PZU’s chief executive since December 22, 2025, says the group is continuing initiatives launched by the previous management. Already active in the Baltic states and Ukraine, PZU does not rule out further expansion abroad, including acquisitions and partnerships under the managing general agent (MGA) model.

Another company expanding beyond Poland is Ebury, a fintech majority-owned by Spain’s Banco Santander. Founded in London in 2009, it focuses on firms engaged in international trade, managing cross-border payments and currency risk. Ebury serves around 25,000 clients globally, including 4,000 in Poland, and plans to double its Polish customer base. Since 2016 it has expanded across Central and Eastern Europe and now operates in eight countries in the region.

Research indicates that among young Poles, the traditional division of the political scene is losing traction. The familiar split between the Civic Coalition (KO) — the country’s largest ruling party, led by Prime Minister Donald Tusk - and Law and Justice (PiS), the main opposition party that governed Poland from 2015 to 2023 and with which President Karol Nawrocki is aligned, is less decisive for this generation. Instead, younger voters tend to sympathize with leaders of the far right, such as Sławomir Mentzen of Confederation (Konfederacja), and the opposition left, including Adrian Zandberg of the Razem party. Nearly half of young people remain undecided, reflecting, at least in part, disappointment with the state.

Former president Andrzej Duda, who served from 2015 to 2025, has found new pursuits. After leaving office, he promoted his autobiography and maintained a videoblog on a channel owned by Krzysztof Stanowski, a well-known sports journalist who ran in last year’s presidential election. Mr. Duda also joined the supervisory board of the fintech company ZEN.com. Most recently, he became an advisor to the Heritage Foundation, a U.S.-based think tank associated with former President Donald Trump.

President Karol Nawrocki, following a series of meetings with the prime minister and government members, invited representatives of parliamentary clubs and caucuses for consultations. Only the Civic Coalition (KO) and the New Left – representing the left flank of the government – declined the invitation. They cited concerns over a possible political setup orchestrated by the president and pointed out that recent meetings with the prime minister were, in their view, sufficient.

At XYZ, we examined an opposition initiative. Recently, Law and Justice (PiS) announced plans to build a new seaport near Poland’s first planned nuclear power plant. We spoke with PiS MP Kacper Płażyński, representing the coastal region, to discuss the rationale behind the project and whether constructing a new port makes sense compared with expanding existing facilities.

On Saturday, the Confederation of the Polish Crown (Konfederacja Korony Polskiej, KKP) held its first programmatic congress. KKP, led by Grzegorz Braun, a controversial MEP known for pro-Russian and anti-Semitic views, secured over 1.2 million votes in the last presidential election.

This week brought more positive economic news. Most notably, GDP in 2025 is estimated to have grown by 3.6% year-on-year. That is higher than in 2024, when growth stood at 3%. Last year, Poland was the fastest-growing large economy in the European Union.

Importantly, growth is holding up even as Poland becomes a more advanced economy. Income per capita (adjusted for price-level differences) has already reached 80% of the EU average. Meanwhile, GDP growth last year slightly exceeded the average recorded in 2010. Moreover, Poland’s pace of convergence with the EU is not slowing.

The main engine of GDP growth in 2025 was private consumption. It rose by 3.7% year-on-year and accounted for nearly 60% of total growth. Public spending and investment also increased. Overall, the structure of growth was healthier than in the previous year.

Consumption is expected to remain the key driver of growth next year. Retail sales – the sale of goods in stores – offer a leading indicator: in December, they rose by 5.3% year-on-year. Consumers ended last year on solid footing and are likely to start the new year the same way, as suggested by consumer confidence indices. Both the current and leading measures of consumer optimism are near their highest levels since the pandemic.

One of the biggest macroeconomic questions is whether the high propensity to save will persist. According to the latest data for Q3 2025, the savings rate increased for the 14th consecutive quarter, reaching 10%. That is well above the 6.2% average recorded in 2016–2019. However, these figures are significantly lagging and subject to frequent revisions.

In financial markets, the main topic was the weakening of the U.S. dollar. The exchange rate against the złoty briefly fell below 3.50 and currently stands at levels not seen since 2018. This is positive for the Polish economy, as it will reduce the cost of imported energy commodities. On the other hand, it could affect the price competitiveness of Polish exports, especially those invoiced in dollars.

The Polish venture capital market is still in a developmental phase. After two years of slowdown caused by temporarily reduced access to public capital, VC funds have resumed investing – including new public-private VC entities. Their activity is already visible in market analyses. In 2025, the value of the domestic VC market, measured as the total capital invested in homegrown startups and technology companies with Polish roots, rose significantly compared with the previous year. Moreover, last year saw two so-called “mega-rounds” – investments that clearly exceeded the market average. ElevenLabs raised PLN 720 million (the largest round of 2025), while Iceye secured PLN 636 million from international funds. We outline the landscape of venture capital in Poland and its distinguishing features.

We also tracked current investment trends in the Polish VC market, which have evolved over the years. The analysis identifies sectors where domestic VC funds are currently seeking technological solutions – from healthcare to defense. Promising projects are scouted not only within Poland but across Central and Eastern Europe and globally. Naturally, artificial intelligence – mirroring global trends – continues to captivate domestic investors’ imagination. AI components across various industries are expected to drive further growth, a fact well understood by Polish investors as well.

Last week, the American technology company Cisco announced plans to expand its own research and development center in Kraków. The PLN 200 million (EUR 43m) investment will create a state-of-the-art data center equipped with advanced laboratory infrastructure and AI solutions. The project has received government support in the form of a grant, which will partially cover costs while also strengthening the company’s collaboration with local universities. Currently, Cisco’s Kraków center provides technological and business services to clients and partners worldwide. It is the company’s largest European location and the main Customer Experience hub for the EMEA region (Europe, the Middle East, and Africa).

Among others, Jagiellonian University – the oldest higher education institution in Poland and one of the country’s top universities – actively collaborates with industry and the business community. In Poland, there is ongoing debate about the future formats of higher education, teaching models, aligning curricula with market needs, and improving the quality of research, its commercialization, and collaboration with companies. We discussed this with the university’s rector. Jagiellonian University has allocated PLN 100 million (EUR 21m) for the development of research infrastructure, treating it as a key element in attracting top scholars. The rector, however, remains skeptical of the government’s internationalization strategy, doubting it will lead to a significant influx of foreign researchers and students.

This week, Deputy Prime Minister and Minister of Digital Affairs Krzysztof Gawkowski is set to present the framework of a digital tax bill, which is expected to primarily target international digital corporations operating in Poland.

“Zakopane. Zakopane” brings together sculptures, kilims, metalwork, and artisanal crafts – ranging from skis and traditional shoes to wooden household items. The display highlights the unique Zakopane style, born from the region’s folklore, landscapes, and artisanal traditions. It’s a rare chance to explore how highland culture shaped Polish art, design, and modern aesthetics, from the colorful costumes of highlander women to the symbolic embroidery in men’s trousers.

This year, the exhibition also includes “Antoni Rząsa. In the Sculptor’s Home”, showcasing 21 pieces by the renowned designer whose chairs attracted international attention at last year’s Milan design fair.

Both shows offer free entry and are complemented by a guided tour on February 5 at 5:30 p.m., led by DESA Unicum experts. Where: ul. Piękna 1A, Warsaw. When: until February 12.

Now, there’s something you need to know about Zakopane. It is a small town (population around 30,000 - not counting tourists) nicknamed the Polish winter capital. Sitting at roughly 800 meters above sea level it's the highest significant settlement in Poland and serves as the country's primary gateway into the Tatra National Park. It's also close enough to Kraków (about 100 km north) that day trips are common, which adds to the traffic and crowd issues the town regularly deals with, particularly in summer and around holidays.

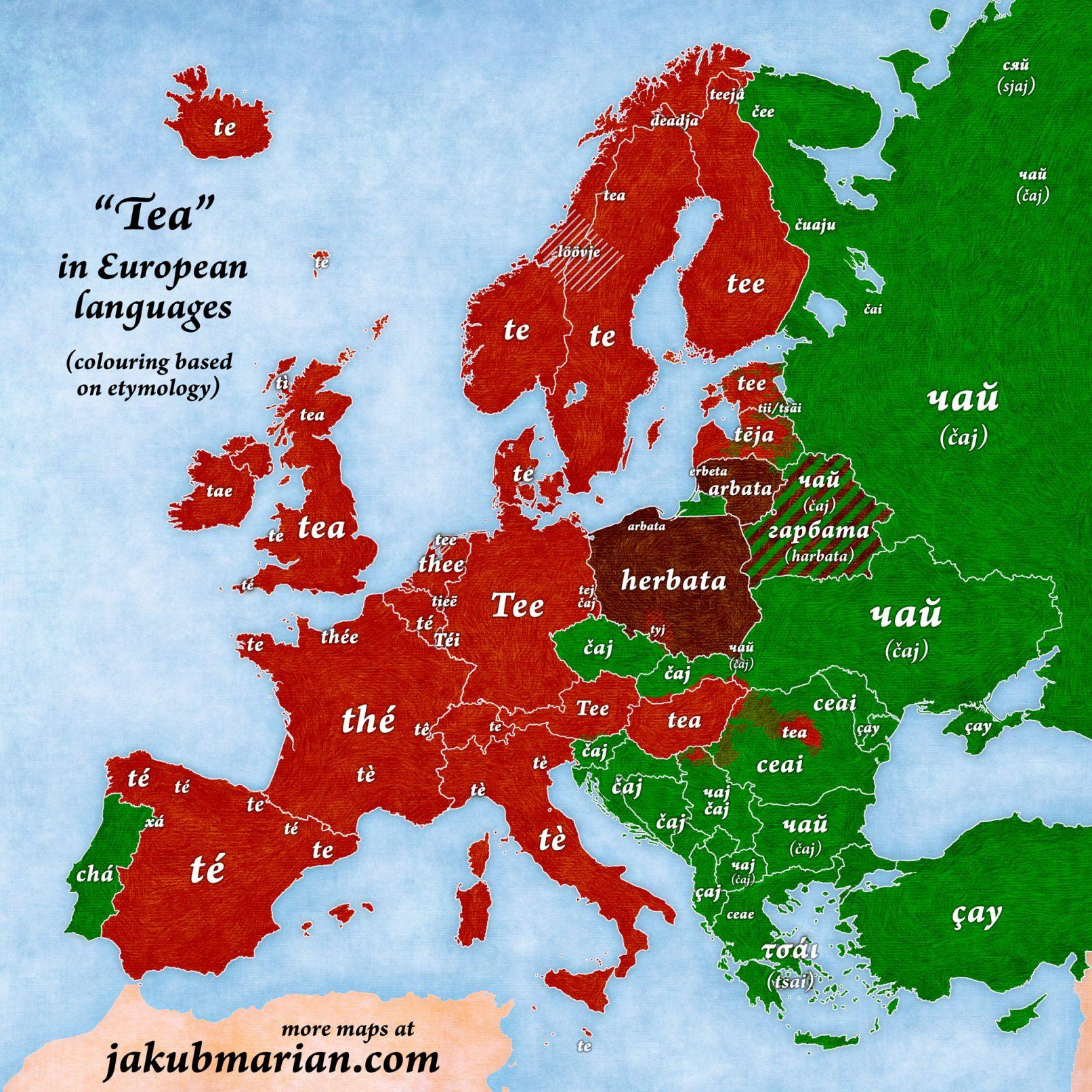

Behold the great European tea divide: "tea" camps west, "tchay" east. And here Poland's "herbata" stands defiant. It's a fun linguistic fossil proving we're brewmasters of our own vocabulary.

Remember: "Tea" gets blank stares. Go native and order with "herbata" like real legends.