Poland Unpacked week 7 (2-8 February 2026)

Welcome to this week’s edition of our Poland Unpacked, where we deliver key insights and trends shaping the economic, corporate and political landscape. Catch the most important insights from Poland in this week’s briefing.

This article is a part of Poland Unpacked. Weekly intelligence for decision-makers

A row over the idea of awarding Donald Trump a Nobel peace prize has spilled over into a diplomatic spat between Poland and the United States. When parliamentary speaker Włodzimierz Czarzasty refused to back a motion supporting Mr. Trump’s candidacy, calling his approach transactional and disrespectful of principles and international law, US ambassador Tom Rose responded by declaring he would cease all contact with him, accusing the Polish lawmaker of “outrageous and unjustified insults”. Prime Minister Donald Tusk, in turn, pushed back, insisting that “allies should respect one another, not lecture each other”.

Historically, few ties have mattered more to Poland than its alliance with the United States. From Woodrow Wilson’s support for independence in 1918 through Washington’s backing for Solidarity in the 1980s and Poland’s entry into NATO, the US partnership has underpinned Warsaw’s place in the Western order. With American troops on Polish soil and close defence cooperation, the relationship remains the backbone of Poland’s foreign policy.

Undisputedly, the number one player in Polish e-commerce is Allegro. The platform, founded in 1999, now generates PLN 12 billion (approximately EUR 2.6 billion) in annual revenue and has expanded into foreign markets. It has successfully fended off incursions by eBay and Amazon, both of which sought to storm the Polish market. Challenging Allegro’s dominance is Erli, a platform launched in 2020, which targeted PLN 2 billion (EUR 440 million) in turnover last year. Both companies are fiercely competing for sellers and customers – and now their battle is moving into the courtroom. Erli has filed a lawsuit against Allegro, accusing the platform of abusing its dominant position. What is the dispute about, and what do experts make of it?

When a Polish company acquires a German one, it is noteworthy – traditionally, the flow of acquisitions has gone the other way. Olavion, a Polish rail carrier owned by the Unimot Group, has just purchased a majority stake in the German company RBP. Further acquisitions are on the horizon, all aimed at building a cross-border carrier. Yet, experts warn, this will not be an easy undertaking. Here is the Polish company’s plan and the obstacles it must overcome along the way.

Maspex, Poland’s largest food industry group, has embarked on another foreign acquisition. Its Romanian subsidiary, Purcari Wineries, has submitted an offer to buy a Romanian wine producer from the Dealu Mare region. “The target is well chosen; it naturally complements Maspex’s product portfolio, and leveraging existing commercial relationships mitigates financial risk,” comments a private equity fund manager familiar with the sector. We also revisit an interview with Maspex’s founder and CEO, in which he explains why he invests in alcohol producers and outlines his growth strategy.

Poland has seen the launch of a think tank unlike any before. It was founded by several dozen Polish entrepreneurs, with Rafał Brzoska and Michał Sołowow – Polish business leaders who have achieved international success – playing leading roles. The Company is a politically neutral think tank that seeks to combine entrepreneurial experience with expert analysis, thereby both supporting innovation and improving the business environment in Poland. Here is how the new organization intends to operate.

A Pole at the helm of a major European institution remains a rarity. That makes it worth noting that, as of April 1, Damian Jaworski will head the European Insurance and Occupational Pensions Authority (EIOPA). The process was not easy: the recruitment lasted six months and included multiple rounds of hearings. He was ultimately approved by the European Parliament. Who is Damian Jaworski, what challenges await him, and what were the behind-the-scenes details of his appointment?

A European arrest warrant has been issued for Zbigniew Ziobro, Poland’s former justice minister. Mr. Ziobro is a vice-president of Law and Justice (PiS), the largest opposition party and Poland’s former ruling party. He served as justice minister in 2005–07 and again from 2015 to 2023. Prosecutors accuse him of 26 criminal offences, including abuse of power and the misuse of public funds. For several months he has been in Hungary, where he – together with his wife – has been granted political asylum by Viktor Orbán.

Meanwhile, Poland 2050 has finally concluded its internal leadership election. The party is one of four members of the governing coalition. The second round of voting had to be rerun after a failure of the electronic voting system. Katarzyna Pełczyńska-Nałęcz, the minister for funds and a former Polish ambassador to Russia, was elected party leader. She replaces Szymon Hołownia, the party’s founder, a former speaker of parliament and a onetime television presenter. New leadership, old challenges.

At the same time, Confederation (Konfederacja), a far-right party competing with Law and Justice (PiS) for conservative voters, has launched an online platform to crowdsource policy ideas. Competition on the right is intensifying. The Confederation of the Polish Crown (KKP), a radical grouping that previously ran joint electoral lists with Confederation, is also gaining momentum.

The rising influence of radical parties goes hand in hand with changing public attitudes towards EU membership. According to the latest polling, as many as 25% of Poles now support a “polexit”. In 2019, only 7% of respondents held that view.

Prime minister Donald Tusk has set up a government task force to investigate alleged Polish links to the Epstein affair. The body will be chaired by Waldemar Żurek, the justice minister.

Last week Mr. Tusk visited Kyiv, where he announced that an international conference on Ukraine’s post-war reconstruction would be held in Gdańsk in June.

President Karol Nawrocki, for his part, travelled to Italy this week for talks with prime minister Giorgia Meloni. On Friday, six months passed since the start of his presidency.

The most important event of last week was the Monetary Policy Council’s (RPP) decision to extend its pause in interest-rate cuts. The reference rate therefore remains at 4%. The previous cut was made in December 2025.

By way of reminder, inflation stood at 2.4% year on year in December, placing price growth almost exactly in the middle of the inflation target. Between May and December 2025, interest rates were cut by a cumulative 1.75 percentage points.

The main rationale for holding policy steady – as explained by Adam Glapiński, president of the National Bank of Poland (NBP), at his press conference – was the absence of new data on inflation dynamics since the RPP’s January meeting. It is only ahead of the March meeting that Statistics Poland (GUS) will publish a flash estimate of inflation for January. March will also bring the NBP’s latest projection, which will indicate the expected effects of the rate cuts implemented so far.

In addition, the economy has delivered a stream of positive news in recent weeks. According to GUS’s preliminary estimate, Poland’s GDP grew by 3.6% in real terms in 2025. Retail sales rose by 5.3% year on year in December, in constant prices, up from 3.1% in November. Industrial output increased by 7.8% year on year in December. These figures point to very strong economic conditions, but from the perspective of monetary policymakers they argue for caution in further easing. Even so, market expectations still point to at least two interest-rate cuts later this year.

As part of one of XYZ’s structural analyses this week, we also examined the issue of declining fertility. Poland’s fertility rate stands at around 1.1, one of the lowest in the world. The fertility crisis is global in nature and by no means confined to Poland. It affects both advanced economies and many emerging ones, including China, India and Brazil.

Since 1995, Poland has ranked among the world’s most stable economies. Crises have been relatively rare and shallow. Over this period, GDP per capita has declined only three times, and in none of those episodes did the fall exceed 3%. The global average is eight downturns, four of them deep. More details are provided in the analysis, which also revisits Poland’s crisis at the turn of the 1970s and 1980s, as well as the fastest post-transition recovery among the countries of the former Eastern bloc.

Another megaround, once again. ElevenLabs – the Polish-born startup – has reached a record valuation of nearly PLN 40bn (about EUR 9.3bn). The milestone follows a new, outsized funding round worth around PLN 1.8bn (roughly EUR 420m). That places the company firmly among the elite of technology firms with Polish roots.

Founded by Mati Staniszewski and Piotr Dąbkowski, ElevenLabs has been taking global AI markets by storm, specialising in audio content generation. Since its inception, the company has raised a total of around PLN 2.8bn (about EUR 650m).

The previous round, closed at the beginning of 2025, brought in about PLN 650m (EUR 150m). The latest financing was led by Sequoia, while Andreessen Horowitz (a16z) significantly increased its commitment. According to the company, a16z quadrupled its stake, while Iconiq tripled its investment. New investors also include Lightspeed, Evantic Capital and BOND, with existing shareholders continuing their support.

A valuation approaching PLN 40bn (EUR 9.3bn) places ElevenLabs among Poland’s most valuable private companies. For comparison, only 11 companies listed on the Warsaw Stock Exchange are valued higher than ElevenLabs, currently estimated at PLN 39.4bn. On the WIG20 index, Dino ranks twelfth at PLN 38.5bn, Allegro sixteenth at PLN 30.6bn, and CD Projekt seventeenth at PLN 25.1bn.

ElevenLabs’ success stands in stark contrast to the broader realities of Poland’s startup ecosystem. While investment activity, funding rounds and ambitious announcements are plentiful, strong capital exits for venture-capital funds remain scarce. The report “Transactions on the Polish VC Market 2025”, prepared by PFR Ventures and Inovo.vc, lists just nine publicly announced exits in the past year. Only five involved Polish companies; the remainder were foreign businesses backed by Polish VC funds. In practice, there may have been more exits that were not disclosed – but the lack of visible, sizeable exits remains a major challenge for Poland’s startup scene. Why is that the case?

That said, the past week brought plenty of activity across Poland’s tech sector. Simpact Ventures, a domestic fund, announced the addition of a new company to its portfolio: Kinderpedia.

Meanwhile, Polish company Singu, backed by an American investment fund, is seeking to conquer the European market for digital property management. Its growth strategy combines organic expansion with acquisitions—and it is moving fast. In early February, Singu acquired the UK-based Synbiotix, which specialises in property management systems for the healthcare sector, primarily hospitals. The company will now operate under the Synbiotix by Singu brand, joining Micad by Singu and the German firm Net-haus, which was acquired in September 2025.

Also worth noting are changes at Fitatu, the well-known calorie-counting app in Poland. The founders have entrusted the company’s international expansion to experienced investors. In a transaction worth several tens of millions of zlotys, a majority stake was acquired by, among others, Maciej Zientara, Wojciech Duda and André Gerstner. The deal proved lucrative for SpeedUp Group - and for Ewa Chodakowska, one of Poland’s most prominent fitness influencers. Fitatu is now headed by the former head of e-commerce at Wakacje.pl, part of WP Holding.

Finally, there have been leadership changes at Startup Poland, one of the country’s most important institutions dedicated to the startup ecosystem. Anna Mazurek has been appointed as the new chief executive, and the foundation’s supervisory board has been significantly expanded.

This week, the Sejm will take up the bill on the status of a “close person.” The proposal is intended as a substitute for registered partnerships, for which there is no consensus - even within the governing coalition.

The president has convened the National Security Council (RBN) this week. An advisory body that brings together members of the government, representatives of all parliamentary parties and senior military officials. The meeting will address the EU’s SAFE program. Both Law and Justice (PiS) and the president would prefer military equipment to be purchased from the United States. Discussions are also expected to cover the Peace Council, which President Nawrocki would like Poland to join, as well as the eastern connections of Włodzimierz Czarzasty, the speaker of parliament from the New Left. Mr. Czarzasty, in turn, has called on the president to explain his own links to hooligan and criminal circles. See how the clash unfolded.

In the 1960s and ’70s, a quietly radical revolution in textile art was born at the Academy of Fine Arts in Warsaw. The exhibition “SOFT POWER. The Warsaw Roots of the Polish School of Tapestry” in Warsaw brings together historical works from that era – including pieces by Magdalena Abakanowicz, Jolanta Owidzka and Wojciech Sadley – with the latest projects by contemporary artists, showing how this Warsaw‑bred movement still resonates in today’s art scene.

The show asks what remains of those original ideas and how the medium of textile continues to shape our understanding of identity, politics, and the human body. Through large‑scale, tactile works, it underscores that fabric is not just a material but a kind of “soft power,” capable of transforming how we see the world.

Where: Krakowskie Przedmieście 5 [entrance from ul. Traugutta], Warsaw

When: 7 February - 6 March 2026

Tue – Sun, 12:00 – 19:00

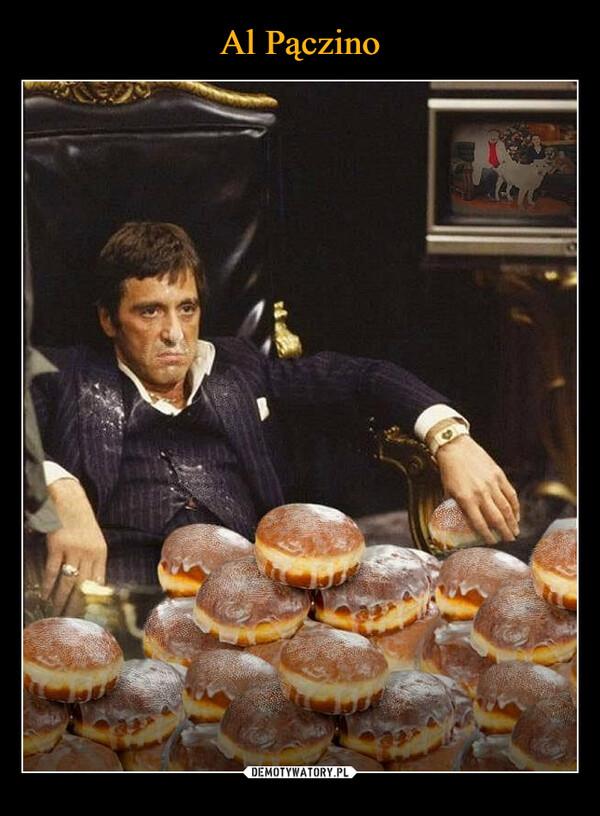

This Thursday is Poland’s unofficial national holiday of carb‑loaded patriotism. Fat Thursday (Tłusty Czwartek). A pastry Armageddon. In a single day, Poles reportedly eat around 100 million pączkis – roughly 2.5 per person.

Now, 95% of Poles participate, while the remaining 5% simply reach for alternatives. One symbolic pączek is not enough: 54% down three to five, 28% settle for two. So, grab your ‘POON‑chek’ this Thursday. Or two.

If you want to blend into the national mood on Tłusty Czwartek, stick to the classic: 90% of Poles still choose traditional pączkis – not the “donut‑style” versions. No offence, but Dunkin’ Donuts has already tried selling their sought-after classics twice in Poland. Not a success story…