This article is a part of Poland Unpacked. Weekly intelligence for decision-makers

Investment has rebounded, according to XYZ’s summary of the Polish Investment Zone’s performance in 2025. The scheme is a support system offering tax exemptions to investors that meet specified criteria for capital expenditure and job creation.

The highest number of projects in four years

In 2025 the 14 companies managing Poland’s Special Economic Zones (SEZs) issued 617 decisions granting investment support. One caveat: the Pomeranian Special Economic Zone has indicated that it may still announce one additional investment in early January. Regardless, this marks the strongest result since the record year of 2021, when 726 decisions were issued. Apart from that exceptional year, no better outcome has been recorded than the one achieved in 2025.

The undisputed leader by number of decisions was the Katowice SEZ. The Pomeranian and Łódź zones also ranked among the top three.

“101 decisions granting support is a record within the Polish Investment Zone,” said Dr hab. Rafał Żelazny, president of the Katowice Special Economic Zone (KSSE).

Kraków Technology Park also surpassed its previous high from 2021 (68), issuing 72 decisions granting investment support.

The largest capital commitments in three years

Companies pledged PLN 21.3 billion (EUR 4.9bn) in capital expenditure. That level had not been seen in either 2023 or 2024.

Among the zones, the Wałbrzych SEZ led the field in terms of investment outlays. The Katowice and Pomeranian zones also made the podium.

“One of our biggest successes has been attracting two international companies: Ascend Elements and Kumho Tire Poland. Both will locate their plants in the Opole-Wrzoski area. It is rare for foreign, multi-billion-zloty investments to be announced in the same place and at the same time,” said Krzysztof Hołub, vice-president of the Wałbrzych Special Economic Zone “Invest-Park”.

The American company Ascend Elements will build a plant producing lithium-ion battery materials for electric vehicles, investing more than PLN 5 billion (EUR 1.2bn), with figures of up to PLN 7 billion (EUR 1.6bn) being discussed. South Korea’s Kumho Tire Poland will invest more than PLN 2 billion (EUR 463m) in its first European tire manufacturing base.

The Słupsk SEZ, managed by the Pomeranian Regional Development Agency, recorded the largest project in its history in 2025. Malta-Decor will build a decorative and impregnated paper factory in Szczecinek with an investment exceeding PLN 800 million (EUR 186m). As a result of this project, total investment commitments in the Słupsk zone have surpassed PLN 1 billion (EUR 233m).

The fewest jobs on record

The results of the Polish Investment Zone (PSI) underscore how far companies have gone in automating production. Fewer than 3,500 jobs are expected to be created by projects declared in 2025 – the lowest figure on record.

On this measure, the Wałbrzych zone again came out on top. Investors in the Katowice zone pledged only slightly fewer positions. By contrast, companies in the Warmia–Masuria zone declared more than 50% fewer jobs.

Everyone has a record of their own

SEZ managers point not only to headline numbers. The Kamienna Góra Special Economic Zone for Small Entrepreneurship counts as a success the investments made by furniture manufacturers operating in Greater Poland. These firms have held their ground despite weaker economic conditions in Germany, their main export market.

“An unquestionable success has been the revival of the Ursus plant in Dobre Miasto. This concerns the former Pol-Mot Warfama facility. After a long period of stagnation and extreme uncertainty, it proved possible to prevent the plant’s physical liquidation. The facility will be expanded and modernized; tractor production will be maintained; the historically Polish Ursus brand will be preserved; and the production of a broad range of agricultural machinery will continue and be developed,” said Marcin Tumasz, president of the Warmia–Masuria Special Economic Zone.

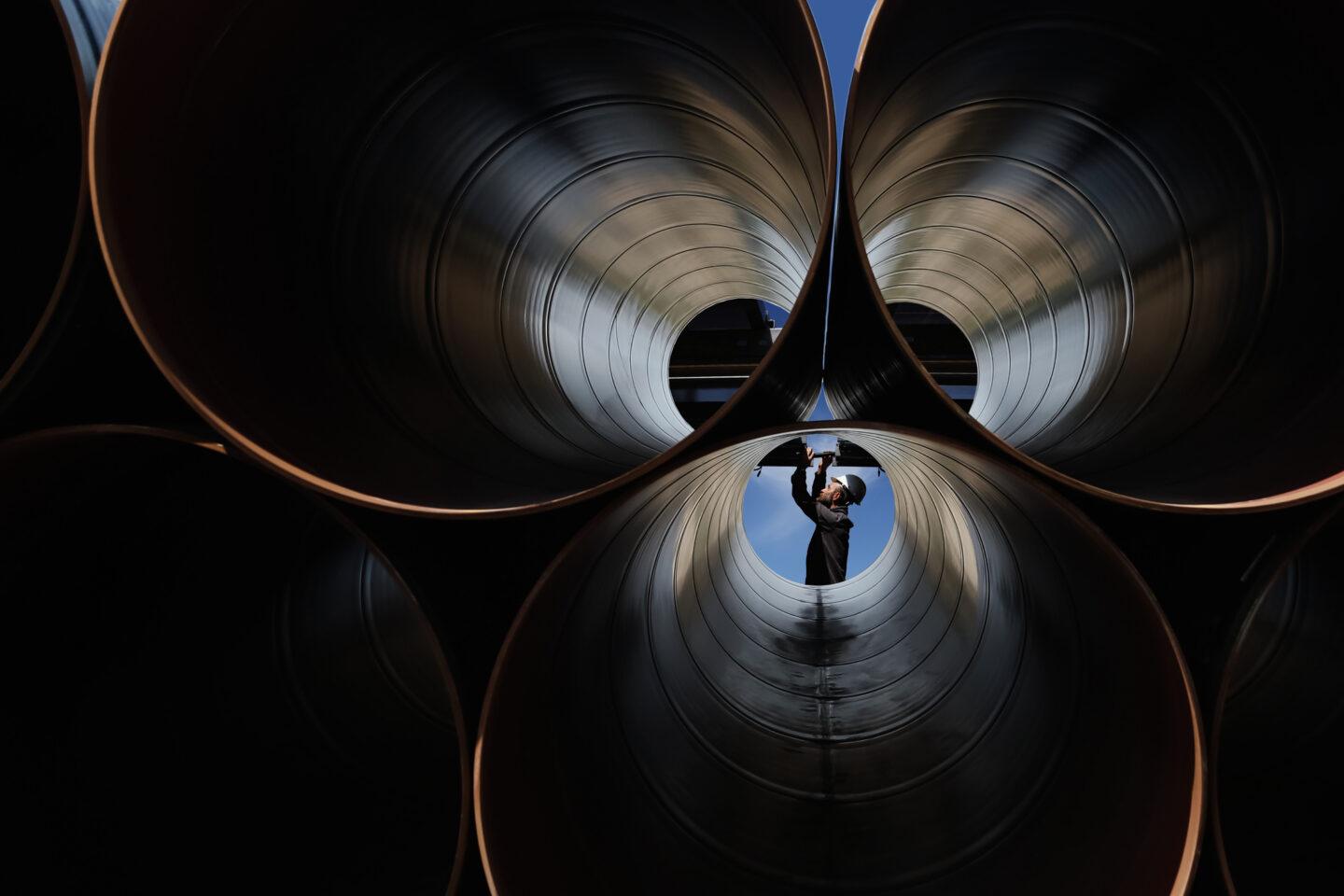

The Legnica zone, meanwhile, secured the Windar project, which will build Poland’s first onshore wind-tower manufacturing plant.

Korean-Polish Rockets in Gorzów Wielkopolski

The Kostrzyn–Słubice SEZ can boast a major defence project. This follows the signing on December 29, 2025, of the so-called third execution agreement. The State Treasury – Armaments Agency, together with a joint-venture consortium of Hanwha WB Advanced Systems and Hanwha Aerospace, will build a factory for CGR 080 precision rockets for the Homar–K systems.

“For the first time in history, such advanced ammunition will be produced in Poland. How did it start? In the second half of 2024, the WB Group – one of Poland’s largest private defense companies – approached us requesting an offer of investment land for its latest defense project. We competed with many cities across Poland, but thanks to our efforts, the Gorzów Wielkopolski location was deemed optimal. On more than 100 hectares, a Polish-Korean factory will be established,” said Tomasz Pisarek, president of K–S SEZ.

This is a result of changes to the Polish Investment Zone. Since July 11, 2025, SEZs have been allowed to provide public support (in the form of tax exemptions) for investments in the defense sector and dual-use technologies. Several such projects are now underway in the zones.

A major entrance for the defense sector

“We issued the first investment support decision among all 14 SEZs for a company in the defence sector. It went to Mesko from Kraśnik, which will invest over PLN 464 million (EUR 108m). We are in talks with a second defence company, but at this stage we cannot disclose its name or the amount,” said Norbert Mastalerz of the Tarnobrzeg Special Economic Zone Euro-Park Wisłosan.

The Wałbrzych zone granted a decision to Black Powder, a manufacturer of, among other things, black powder for civilian and military use, which will invest PLN 12 million (EUR 2.8m).

“Additional support decisions for defense-sector companies will follow shortly,” said Teodor Stępa, vice-president of WSSE.

Kraków Technology Park (KPT) issued a decision for Ponar Wadowice, Poland’s largest producer of hydraulic components and systems for the mining, machinery, and defence industries. The planned investment is PLN 99.4 million (EUR 23.1m).

“Discussions with other entities are ongoing, but due to the security and sensitive nature of these projects, we cannot disclose details at this stage,” emphasized Justyna Czyszek, deputy director of investor services at KPT.

Drone Valley in the Aviation Hub

Two drone manufacturers are investing in the Mielec SEZ.

“Bezzałogowe Systemy Lotnicze (Unmanned Aerial Systems) will invest PLN 17.4 million (EUR 4m) in Mielec, while Ekolot Aerospace and Defence will commit PLN 86.6 million (EUR 20.1m). With plans to create drone valleys in the Podkarpackie region, many companies are showing interest in locating drone production projects here,” said Wiktor Cichoń of SSE Euro–Park Mielec.

The Katowice zone has the largest number of such projects.

“In 2025 we issued four support decisions for investments in the defence sector, including dual-use technologies. Their total value is around PLN 64 million (EUR 14.9m). We are also in talks regarding three major investment projects,” said Rafał Żelazny.

Other zones conducting discussions include Kamienna Góra, Łódź, Słupsk, Pomerania, and Warmia–Masuria.

“For a company not already in the defense sector, starting production for the industry is not easy. It requires obtaining a license, which involves a very lengthy process. We organized a training session for entrepreneurs, attended by a representative of the Polish Armaments Group. As entrepreneurs tell us, this market is fairly closed, and entering it as an outsider is not simple,” said Marcin Tumasz.

Turning setbacks into success

Not everything went smoothly in the Polish Investment Zone. Intel ultimately withdrew from plans to build a semiconductor integration and testing plant in Środa Śląska–Miękinia. It would have been Poland’s largest-ever investment, worth nearly PLN 20 billion (EUR 4.6bn).

“On the other hand, LSSE now offers the best investment land in Europe, according to Kearney’s report on the back-end semiconductor manufacturing sector. It is a fully serviced investment site covering nearly 300 hectares,” said Magdalena Barczyk-Monteiro, deputy director of the Investor Services Department at the Legnica zone.

For the president of the Katowice SEZ, a setback was the lack of a decision on a major defence-sector investment. Tomasz Sadzyński, president of the Łódź SEZ, did not secure such an investor in 2025 but hopes to do so in 2026. In the Suwałki SEZ, no new companies arrived; all support decisions concerned reinvestments.

“These were made possible by the regulation of June 13, 2025, which, among other things, lowered quantitative criteria in border counties – a change we had been advocating since 2024. This allowed us to attract 12 investors who had not previously benefited from tax exemptions in the zone,” emphasized Cezary Cieślukowski, president of the Suwałki zone.

For the Warmia–Masuria SEZ, the disappointment lies in the so-called “white plans”—areas in the Warmia–Masuria region and the northern part of the Mazovia region under its management that remain undeveloped.

Challenges ahead

SEZ representatives acknowledge that 2026 will be a demanding year. At the end of the year, the old permits for operating in the zones will expire. These had been issued up to 2018, when Special Economic Zones were transformed into the Polish Investment Zone. Since then, companies receive investment support decisions instead. This means that “legacy” investors will no longer pay administrative fees for zone management.

“A major challenge will be attracting companies that hold permits but do not yet have support decisions, so they can transition smoothly from one program to the other,” said Norbert Mastalerz of TSSE.

That is not the only issue.

“The appetite for new greenfield investments is limited. There is macroeconomic uncertainty. Energy costs and access to financing are challenges. There is still pressure on traditional metrics, such as creating new jobs and maintaining existing ones, while investments increasingly rely on automation and robotics,” noted Justyna Czyszek of KPT.

Arkadiusz Dybiec, president of the Kamienna Góra zone, points to the lack of reinvestment opportunities for large companies in the Lower Silesia and Greater Poland regions.

“We plan to take action on this issue. Toyota Boshoku’s reinvestment in Wykroty was carried out without public support,” said Dybiec.

A promising year ahead

At the same time, PSI representatives are entering 2026 with optimism.

“This year, we are counting on at least one major foreign investment. The Wrocław–Jawor area, covering 180 hectares, offers opportunities; it is one of the largest and best-prepared investment sites in Poland, particularly for high-tech and semiconductor companies,” said Krzysztof Hołub of WSSE.

Rafał Żelazny is eyeing another record.

“We have grounds to expect that we will carry out more large-scale investment projects, including those involving foreign capital,” said the head of the Katowice zone.

Tomasz Sadzyński pins his hopes on the construction of a new production and warehouse hall on Stokowska Street in Łódź, the finalization of negotiations and economic missions in Japan, closer cooperation with Port Polska, the defense sector, and further development of startup services.

“With calm and hope, we enter 2026. We are seeing signs of revival among Polish entrepreneurs, despite the still difficult situation across our eastern border. We are conducting many advanced discussions with investors,” said Sławomir Koprowski, head of the Słupsk zone.

The Tarnobrzeg zone is expecting the arrival of subcontractors from the defense sector. It will offer entrepreneurs two additional production and warehouse halls in Tarnobrzeg and Chełm.

“We see development opportunities, especially in the context of new support instruments, the growth of strategic investment parks, and the energy transition. The construction of nuclear power plants, the development of offshore wind energy, and energy infrastructure are shifting Poland’s energy center northward. This is accompanied by growing interest in the region from high-tech companies,” said Mirosław Kamiński, president of the Pomeranian Special Economic Zone.

XYZ reported that the Ministry of Economy is working on an amendment to the law supporting new investments, aimed at “maximizing the potential” of the Polish Investment Zone.

Key Takeaways

- In 2025, the 14 companies managing Poland’s special economic zones (SEZs) issued 617 support decisions. This is the highest number since the record-breaking year of 2021 and exceeds the total for all other years in the past decade. Companies announced investment outlays of PLN 21.3 billion (EUR 4.6 billion), a figure last exceeded in 2022. The number of jobs expected to be created through these projects is the lowest in more than a decade, at 3,500. It is worth noting, however, that the number of jobs maintained in expanded facilities reaches tens of thousands. In terms of the number of decisions issued, the Katowice zone leads, while the Wałbrzych zone accounts for the largest investments and the highest number of new jobs.

- Most SEZ management companies are in talks with firms planning investments in the defense and dual-use sectors. In the Kostrzyn–Słubice Special Economic Zone, a rocket manufacturing plant is set to be built by a consortium of the Korean company Hanwha and WB Electronics. Such weapons are not yet produced in Poland. Other projects in this sector are planned in the Polish Investment Zone, including Mesko in Kraśnik (over PLN 464 million / EUR 100 million), Black Powder in the Wałbrzych zone (PLN 12.5 million / EUR 2.7 million), Ponar Wadowice (PLN 99.4 million / EUR 21.5 million), and in the Mielec zone—where the drone valley is expanding - Bezzałogowe Systemy Lotnicze (PLN 17.4 million / EUR 3.8 million) and Ekolot Aerospace and Defense (PLN 86.6 million / EUR 18.7 million).

- By the end of 2026, investors operating in SEZs under the old permit system (issued until September 2018) will no longer be eligible for tax exemptions. They will also stop paying the SEZ fee, which will reduce revenues for the management companies. Support decisions, however, will remain in force. Some companies are expanding their facilities and transitioning from permits to support decisions, thus securing continued corporate income tax relief while ensuring revenue streams for the zone operators.